Aspire vs Airwallex: Why I Switched My Business Card Provider (And What Entrepreneurs Should Know)

- Joyce Tsang

- Jul 22, 2025

- 4 min read

Updated: Oct 2, 2025

Why Business Cards Still Matter for Entrepreneurs

As a solopreneur running a boutique consultancy, juggling marketing, operations, sales, and finance means every tool I use needs to work hard and work smart.

When it came time to choose a financial platform to handle business spending and subscriptions, I tried two rising fintech players: Aspire and Airwallex. Here’s my real-world experience with both—and why one won my trust while the other pushed me to switch.

Aspire: A Slow Start and Rapid Letdown

I was introduced to Aspire through Osome, my accounting service provider. Their notifications highlighted Aspire’s digital debit card service, which piqued my interest—I hadn't yet bothered to open one through my corporate bank account at Hang Seng.

Onboarding:

Setting up the account was fast. I uploaded business details and statements easily. But approval dragged out: from my initial application on Feb 21, 2024, to still chasing final setup by March 27, 2024. Multiple email follow-ups added to the delay.

Usage & Features:

Aspire offers digital debit cards only at the time, but lets you create multiple cards with monthly budgets for different teams or purposes (like Marketing). All draw from one topped-up pool. There were no fees—but when they changed the top-up bank account mid-way, I had to set up a new beneficiary from my corporate bank, which was an added admin step.

Functionally, it served as a subscription hub, but never felt seamless. I used it for monthly payments—until things went south. In addition:

After the second login verification, even when you're already on your dashboard, you still need to enter an SMS code every time you want to reveal your debit card number. It's a hassle.

Not long after registering, individual customer success managers began reaching out to upsell me on other products and encouraged me to schedule a call. I found this quite annoying and absurd, especially since they hadn’t taken the time to review my profile or personalize the email. It felt like they had no idea what I actually do or how I use their platform.

Crucial notifications are sent via email instead of being flagged within the platform—which is a definite miss. Seeing email subject lines like “Your HKD card account details are changed!!!” comes across more like a suspicious scam than a legitimate message from the company.

With inquiries, you typically face one of two scenarios: either endless follow-ups with cookie-cutter 'We're handling this and will respond in X business days' emails, or—worse—a barrage of unscheduled calls from Singapore. (I found the latter particularly disruptive!)

The Experience That Broke Trust

Here’s where Aspire lost me:

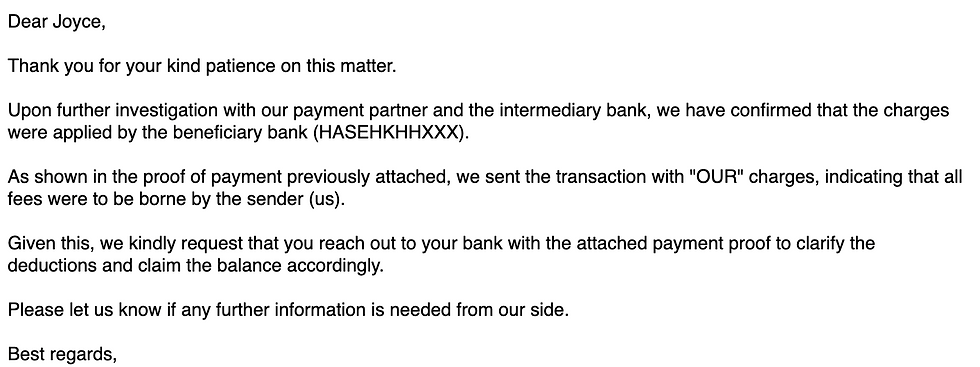

On June 3, I topped up my account. By June 4, the funds hadn’t reflected, so I contacted their team. Over the next 15 days, five different staff members got involved. Some took days to respond. Others offered no clear explanation. Eventually, I was the one who had to investigate and escalate—calling my bank, submitting proof, and chasing for updates.

It wasn’t until June 12 that Aspire finally admitted their system failed to log the transaction—something they could have told me within two days. Even then, on June 18, I was still told to wait another 2–3 business days for just a response. Meanwhile, my business subscriptions were being disrupted.

This led to a hard conclusion: Aspire was no longer trustworthy.

Airwallex: Everything Aspire Should’ve Been

Airwallex first came to my attention through Cantonese-language social ads. It felt local, relevant, and well-presented. I chose to research them after Aspire’s failure—and what followed was a masterclass in customer experience.

Onboarding:

Within one working day, I had a clear answer to my inquiry from a real agent. I applied, got approved, and had full platform access within hours. Fast, clear, and frictionless.

Bonus Features:

Airwallex provides physical debit cards, and mine arrived—beautifully packaged—within 5 working days. That gesture alone made me feel valued as a solopreneur.

Their multi-currency FX engine is baked into the platform. You can top up in HKD, then spend in USD or CAD—the system handles the conversion automatically and seamlessly. I’ve tested this and found the exchange rate reliable, matching global standards.

What to Consider Before Switching Providers

I value:

Speed: I don’t have time to chase platforms for basic functions.

Simplicity: Set it up. Let it work.

Support: A real human who solves problems, not just escalates them.

Flexibility: Multi-currency, physical cards, intuitive budgeting.

Trust: If you fail me once, my business pays the price.

Aspire vs Airwallex: Key Differences I Noticed

Feature | Aspire | Airwallex |

Onboarding Speed | 5+ weeks with multiple delays | Same-day approval and setup |

Customer Support | Fragmented and slow | Responsive and proactive |

Debit Card Type | Digital only | Digital + Physical card |

FX Support | Recently introduced, untested | Seamless multi-currency support |

Subscription Usage | Functional but unreliable | Efficient and robust |

Value to Entrepreneurs | Low | High |

Aspire might still work for others. But for entrepreneurs who wear a dozen hats and value speed, clarity, and reliability— Airwallex has my vote.

If you're on the same path, exploring better systems and smarter ways to grow your brand—I’d love to help.

👉 Book a free 30-minute strategy call with me to talk tools, workflows, and brand-building tactics.

📩 Subscribe to my VIP newsletter for exclusive insights on my entrepreneurial journey—including product reviews, tool hacks, and honest lessons learned.

💡 Or simply check out my Content Marketing Tools page to explore the top tools I use to manage my business as a solopreneur. You might just discover the solution you've been searching for.

Let’s make your business smarter, faster, and stronger—together!

Comments